We offer a variety of unique loans; whether you are looking for your first car or want to consolidate your bills into a lower monthly payment or maybe even achieve the ultimate dream of building your own home!

Hawaii First FCU is here to give you your first chance or even second-chance at borrowing, even if you think that your credit is not good enough.

Be sure to apply with us today to see what you qualify for and get pre-approved!

Auto Loans

New/Used Vehicles

Finance your new car, truck, or van with us as receive rates as low as 5.50% APR! We also offer competitive used auto loan programs. Contact us today!

First-Time Auto Loan

Buying a car is a big deal. Getting your hands on the keys is often harder for first-time buyers. Don’t go to the dealership without a plan to pay for your new ride.

Real Estate Loans

Construction Loans

Are you planning to build this before the year is over? Bring your dreams to life with help from our Construction Loan! Change your scenery with help from our local experts. Plan your home and build your new life.

Department of Hawaiian Homelands

We specialize in Department of Hawaiian Home Lands loans.

Mortgage

Whether it is your first home, your retirement home or your dream home, we are here to help!

Check our mortgage rates for further information.

Vacant Land Property Loans

Secure your piece of Paradise now and enjoy the benefit of our payment plan while dreaming up your new home

To learn more, contact our Homeownership Supervisor, Sharon Low NMLS #790063, at sharon@hawaiifirstfcu.com or call 808.319.2184.

Personal Loans

Our personal loan is your perfect solution to make purchases or pay for your dream trip. From vacation travel, holiday spending, or even an appliance purchase, you can get the money you need without spending a fortune. Featuring a fixed low rate and an easy-to-make payment, apply for a personal loan today!

Pot of Gold Savings Loan

Our Pot of Gold Savings Loan helps members set aside funds on a regular basis so that life’s unexpected emergencies don’t become financial emergencies. This special offer provides you with 50% of your loan and in cash with the other 50% going right to your savings account. Interested? Stop by to apply for yours today.

Personal Line of Credit (LOC)

Have a recurring need to borrow or want a great option for unexpected emergencies? The Personal Line of Credit (LOC) may be the perfect option for you. With a Personal LOC, you have access to funds when you need them. No more waiting for loan approvals or having to apply. Simply transfer the funds you need when you need them. Open yours today!

Overdraft Line of Credit (LOC)

Don’t you hate overdraft fees? We do too! That’s why Hawaii First offers an Overdraft LOC to help our members avoid fees and gain peace of mind. Open an Overdraft LOC and know your transactions will be covered, each and every time. Featuring rates as low as 9.00% APR, this line of credit is transferred in increments of $50 to help cover any unexpected or unplanned expenses.

Credit Cards

Our Visa® Credit Card is here to help your ‘ohana get the very best in life. Use it for everyday purchases, unexpected expenses or the one thing you’ve had your eye on! With low rates, you can get the most for your money, today! Paying your Visa® bill online couldn’t be easier! Use the safe and secure site to pay your Visa® bill each month at ezcardinfo.com. Enroll quickly with a few simple steps and you’re ready to make a payment, view your current balances and previous statements online! Check out ScoreCardRewards.com for information on points!

- No annual fee

- Fixed APR

- As low as 8.95% APR*

- Travel with peace of mind with a Hawaii First Visa®

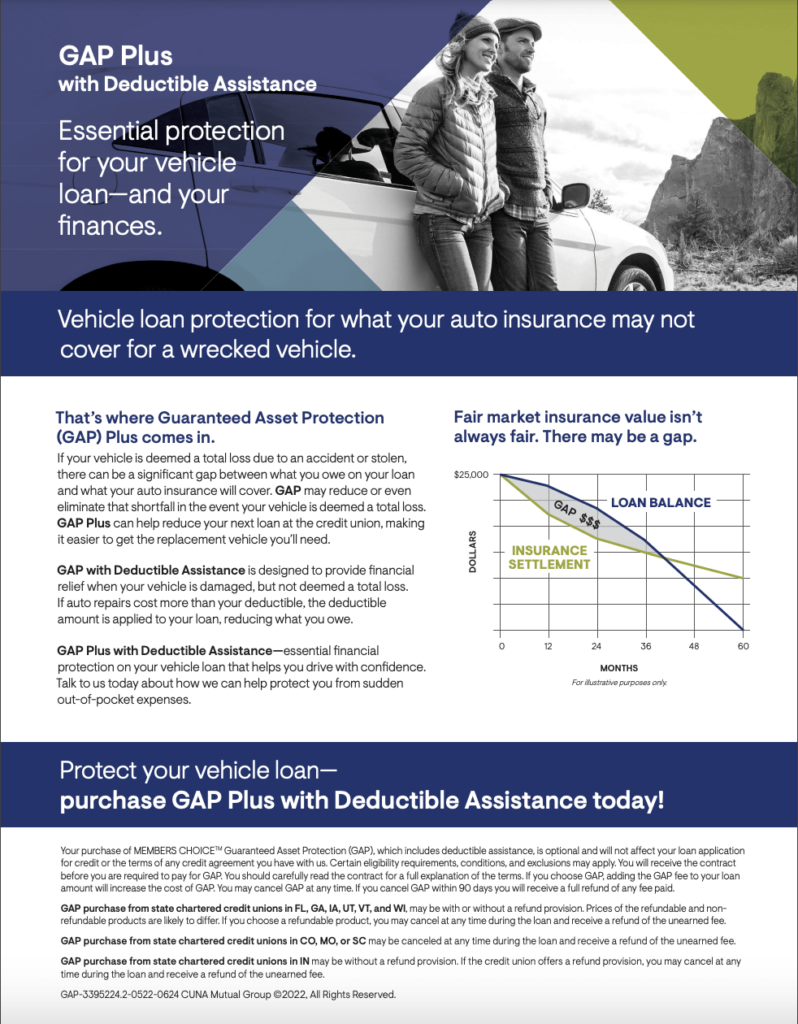

Credit Insurance

Every year has its ups and downs, there’s no way around it. There is a way, however, to put your mind at ease when it comes to your loan payments.

We offer Credit Insurance* to make sure your financial stability is not something you stress. Life is beautiful but filled with surprises — both welcome and not — don’t allow your financial stability to hang in the balance of unpredictability. Get the protection you need today with our Credit Insurance.

Stop by for more info!

*APR=Annual Percentage Rate. See credit union for full details. Federally insured by NCUA.